How should you view and manage your retirement savings plan through various life stages?

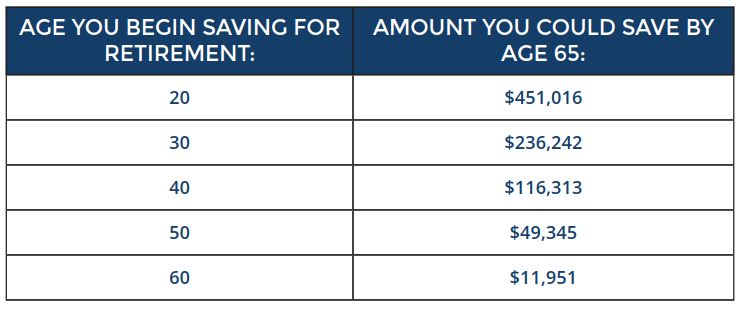

To help improve your chances of achieving a financially comfortable retirement, start with a realistic assessment of how much you’ll need to save. If the figure is substantial, don’t be discouraged — the most important thing to consider is to begin saving now. Although it’s never too late to save for retirement, the sooner you start, the more time your investments have to potentially grow.

The chart below shows how just $2,000 invested annually at a 6% rate of return might grow over time:

This is a hypothetical example of mathematical principles, is used for illustrative purposes only, and does not reflect the performance of any specific investment. Results assume reinvestment of all earnings. Fees, expenses, and taxes are not considered and would reduce the performance shown if they were included. Actual results will vary.

GETTING MARRIED AND STARTING A FAMILY

You will likely face even more obligations when you marry and start a family. Mortgage payments, higher grocery and gas bills, child-care and youth sports expenses, family vacations, college savings contributions, home repairs and maintenance, dry cleaning, and health-care costs all compete for your money. At this stage of life, the list of monthly expenses seems endless.

Although it can be tempting to cut your retirement savings plan contributions to make ends meet, do your best to resist temptation and stay diligent. Your retirement needs to be a high priority.

PREPARING TO RETIRE

With just a few short years until you celebrate the major step into retirement, it’s time to begin thinking about when and how you will begin drawing down your retirement plan assets. You might also want to adjust your investment allocations with an eye towards asset protection (although it’s still important to pursue a bit of growth to keep up with the rising cost of living).

You may want to discuss:

- Health care needs and costs, as well as retiree health insurance.

- Income-producing investment vehicles.

- Tax rates and living expenses in your desired retirement location.

- Part-time work or other sources of additional income.

- Estate planning.

You’ll also want to familiarize yourself with required minimum distributions (RMDs). The IRS requires that you begin drawing down your retirement plan assets by April 1 of the year following the year you reach age 70½. If you continue to work for your employer past age 70½, you may delay RMDs from that plan until the year following your actual retirement.

Janney Montgomery Scott LLC Financial Advisors are available to discuss the suitability and risks involved with various products and strategies presented. We will be happy to provide a prospectus, when available, and other information upon request. Please note that the information provided includes reference to concepts that have legal, accounting and tax implications. It is not to be construed as legal, accounting or tax advice, and is provided as general information to you to assist in understanding the issues discussed. Neither Janney Montgomery Scott LLC nor its Financial Advisors (in their capacity as Financial Advisors) give tax, legal, or accounting advice. We would urge you to consult with your own attorney and/or accountant regarding the application of the information contained in this letter to the facts and circumstances of your particular situation. Janney Montgomery Scott LLC, is a full-service investment firm that is a member of the NYSE, the FINRA and SIPC. Prepared by DST Systems, Inc. Copyright 2019.

Please be advised that any materials provided to you by a financial advisor have not been reviewed or approved by the Carpenters. These materials have been prepared solely by the respective financial advisors. The information provided to you is for information and illustrative purposes only and does not purport to show actual results. It is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action. Opinions expressed therein are current opinions as of the date appearing in this material only and are subject to change without notice. Any information provided to you is done so with the understanding that you will make your own independent decision with respect to any course of action in connection herewith and as to whether such course of action is appropriate or proper based on your own judgement, and that you are capable of understanding and assessing the merits of a course of action. The Carpenters do not purport to and do not, in any fashion, provide tax, accounting, actuarial, recordkeeping, legal, broker/dealer or any related services.