EAS Benefit Funds "My Profile" Account

The "My Profile" dashboard, is your account for all things benefit related, that are unique to you. Track your work history, health coverage eligibility, annuity balance, and pension accrual in real time. For help creating your account, please checkout the tutorial video.

Health Coverage Eligibility Requirements

Initial Eligibility

To become initially eligible for benefits as an Active Covered Participant, you must be in the Eligible Class and reach 600 or more Credited Hours in a 6 month time-frame. Your coverage would begin the first day of the second month following the month after your 600th hour was worked.

For example, If you work your 600th hour in November, your coverage will start on January 1st.

|

August |

150 |

|

September |

150 |

|

October |

150 |

|

November |

150 |

In the example above the 600th hour is worked in November, which would be paid in December, and that would make you eligible for the first time on January 1st.

Continuing Eligibility for Health Coverage

In order to continue to receive benefits as an Active Covered Participant from the Plan at the beginning of any Benefit Period, you must be in the eligible class, and have a Qualifying Work Period. As an Active Covered Participant, you and your eligible family members are covered for health care benefits which vary depending on whether you are eligible for Silver Coverage or Gold Coverage. Different hours requirements apply to earn coverage under the Plan depending on whether you are a Commercial Carpenter or a Light Commercial Carpenter

There are 2 Eligibility Periods per Plan Year:

April 1st and October 1st

Click here for coverage level details and hours requirements.

Health Coverage Eligibility Levels

GOLD LEVEL

- Commercial Active Eligibility - 600 or 1200 hours

- Light Commercial Active Eligibility - 850 or 1700 hours

- Out-of-Pocket Maximums $1,000 / $2,000

- Prescription Coverage

- Cigna Dental

- Davis Vision

- 0.50 Active Health Plan Credit

SILVER LEVEL

- Commercial Active Eligibility 450 or 900 Hours

- Light Commercial Active Eligibility 650 or 1300 Hours

- Out of Pocket Maximums $2,000 / $4,000

- Prescription Coverage

- No Dental Coverage

- No Vision Coverage

- 0.25 Active Health Plan Credit

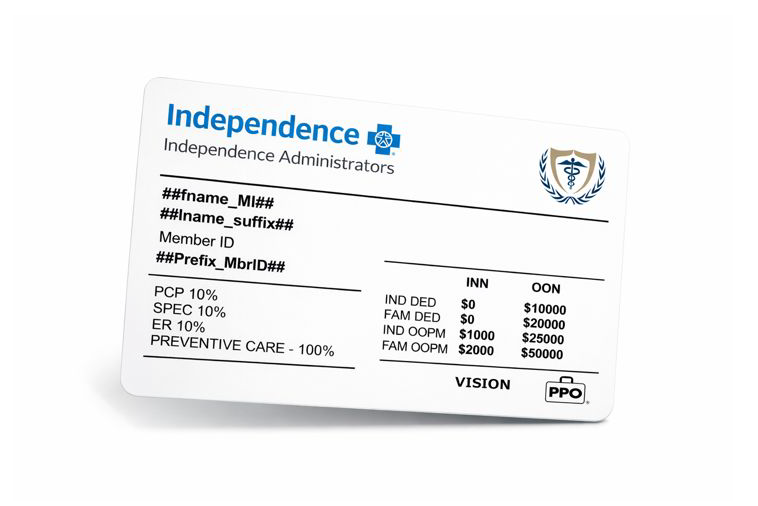

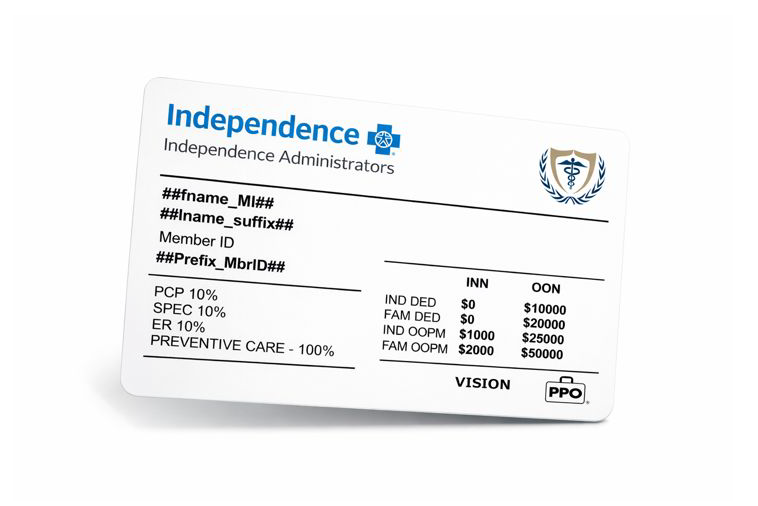

Look for These Cards

Mailed in Separate Envelopes

Medical and Vision Card

This is for your major medical insurance and vision benefit. You should receive your cards about 2 weeks after you become eligible for benefits. Use it when visiting doctors, hospitals, or specialists.

Prescription Card

Prescription coverage is through Express Scripts. You should receive your cards about 2 weeks after you become eligible for benefits. Use it at the pharmacy for all prescriptions.

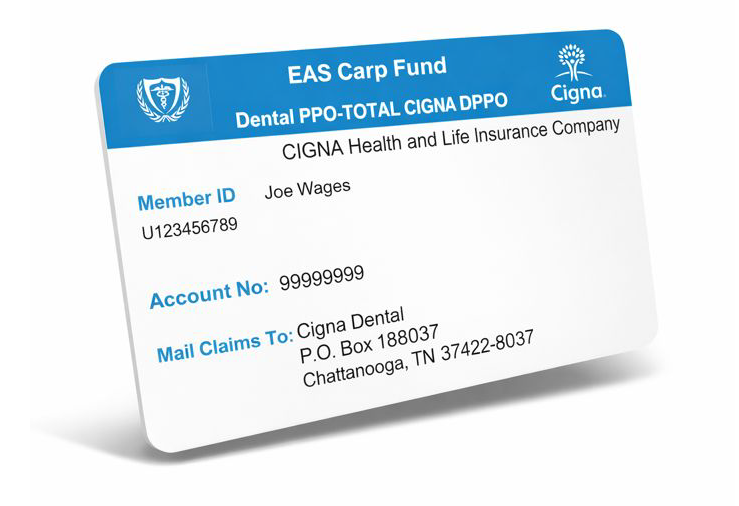

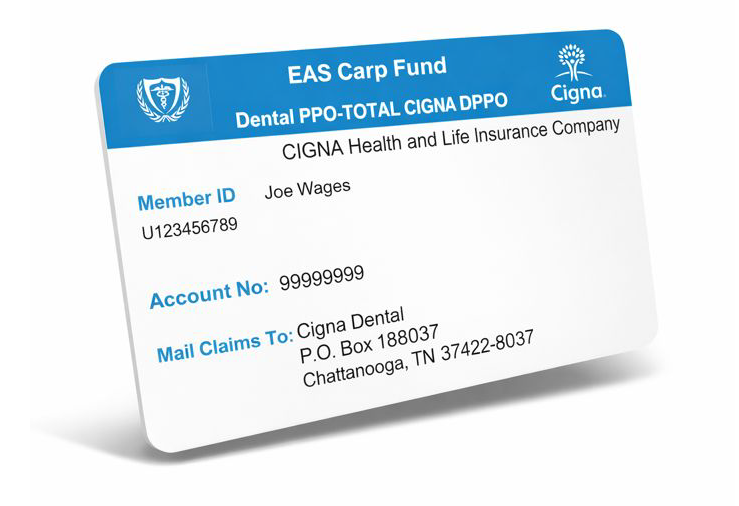

Cigna Dental Card

Dental coverage is through Cigna Dental. You and your eligible dependents will receive this cards about 3 to 4 weeks after you become eligible for benefits.

Health Reimbursement Card (HRA)

If you are an HRA-eligible Participant, you will receive two (2) HRA Payment Cards at your home address that you and your family can use for point-of-sale eligible expenses.

Look for These Cards

Mailed in Separate Envelopes

Medical and Vision Card

This is for your major medical insurance and vision benefit. You should receive your cards about 2 weeks after you become eligible for benefits. Use it when visiting doctors, hospitals, or specialists.

Prescription Card

Prescription coverage is through Express Scripts. You should receive your cards about 2 weeks after you become eligible for benefits. Use it at the pharmacy for all prescriptions.

Cigna Dental Card

Dental coverage is through Cigna Dental. You and your eligible dependents will receive this cards about 3 to 4 weeks after you become eligible for benefits.

Health Reimbursement Card (HRA)

If you are an HRA-eligible Participant, you will receive two (2) HRA Payment Cards at your home address that you and your family can use for point-of-sale eligible expenses.

Prescription, Dental, and Vision Benefits

PRESCRIPTION COVERAGE

- 90-day supplies covered through CVS or Express Scripts Mail Order

- Generic Medications: $5 for 30-day / $10 for 90-day supply

- Preferred Brand Medications: 25% coinsurance

- Non-Preferred Brand Medications: 40% coinsurance

CIGNA DENTAL COVERAGE

- $2,500 Annual Family Allowance

- Check-ups Covered 100%

- $3,200 Lifetime Orthodontia Allowance

- Cigna PPO

VISION BENEFIT

- Vision Exams Covered at 100%

- $100 Allowance for Eyewear

- Additional $50 Allowance at Visionworks.

- Covered Once Per Year

Prescription, Dental, and Vision Benefits

PRESCRIPTION COVERAGE

- 90-day supplies covered through CVS or Express Scripts Mail Order

- Generic Medications: $5 for 30-day / $10 for 90-day supply

- Preferred Brand Medications: 25% coinsurance

- Non-Preferred Brand Medications: 40% coinsurance

CIGNA DENTAL COVERAGE

- $2,500 Annual Family Allowance

- Check-ups Covered 100%

- $3,200 Lifetime Orthodontia Allowance

- Cigna PPO

VISION BENEFIT

- Vision Exams Covered at 100%

- $100 Allowance for Eyewear

- Additional $50 Allowance at Visionworks.

- Covered Once Per Year

Benefit Coverage Explainer Videos

Important Online Forms

EAS Carpenters Pension Plan

Plan Year: January 1st - December 31st

The Eastern Atlantic States Carpenters (EAS) Pension Plan is a Defined Benefit Pension offered to Active Participants across the jurisdiction of the EAS Regional Council of Carpenters that includes Pennsylvania, New Jersey, Delaware, Maryland, Virginia, West Virginia and other neighboring jurisdictions by Collective Bargaining Agreement.

Annual Pension Accrual Calculation

1% of required Annual Employer Contributions made on your behalf

- For example: $20,000 Annual Employer Contribution = $200 Accrual ($20,000 x 1% = $200)

*Please note that not all Collective Bargaining Agreements have the same rates. This example for illustration purposes only.

Additional Pension Plan Details

EAS Carpenters Pension Plan Active Participant

You become an "active" participant in the Pension Fund at the end of the Plan Year (January 1 - December 31) in which you work in Covered Employment for 800 hours or more. Once you meet the initial eligibility requirement, your eligibility will continue as long as you remain an Eligible Employee and obtain at least 200 hours in each Plan Year.

|

200-399 hours |

¼ year Vesting Service |

|

400-599 hours |

½ year Vesting Service |

|

600-799 hours |

¾ year Vesting Service |

|

800+ hours |

1 year Vesting Service |

Eastern Atlantic States Pension Plan Year runs January 1st - December 31st

- Current Vested Participants will automatically be vested in the new Pension Plan and previous Credited Service will be carried over.

- Non-Vested Philadelphia Participants with one hour of service pre-merger will be grandfathered under the current 3-year Vesting Service Rule.

- If you had Credited Service in both New Jersey and Philadelphia Funds, they will be combined.

- New Participants on or after January 1, 2023 will be subject to 5-year vesting.

- Hours on or after the merger date will be credited as follows:

|

200-399 hours |

¼ year Vesting Service |

|

400-599 hours |

½ year Vesting Service |

|

600-799 hours |

¾ year Vesting Service |

|

800+ hours |

1 year Vesting Service |

When Can I Retire?

Normal Retirement Eligibility:

- Age 65 with 5 years of Credited Service

Early Retirement Eligibility:

- Age 55 with 10 years of Credited Service

Former Philadelphia Participants with 1-hour pre-merger are eligible to retire if they meet pre-merger early retirement rules (i.e. 52/33, 53/32, or 54/31)

Additional Plan Changes:

Disability Retirement Benefits:

- SSA disability award

- 10+ years of Credited Service

- Ceases to be an Active Participant because of disability

- Onset while Active and during a period of 10 or more Consecutive Years of Service

- Furnish all information the Board requires

- Subject to 3% age reduction factor if less than 20 years of service (21% cap)

- See Retirement Benefits and Qualifications

Unreduced Joint and Survivor Option:

- Participants retiring on or after age 65 may be eligible for an unreduced Joint and 100% Survivor form of benefit. See Types of Monthly Retirement Options

Post-Retirement Death Benefit:

- A minimum post-retirement death benefit of $10,000 is payable with respect to Normal, Early and Disabled Retirees.

- If the post-retirement death benefit accrued through the date of the merger is greater than $10,000, the higher amount will be payable. See Pension Plan Death Benefits

EAS Carpenters Annuity Plan

Plan Year: January 1st - December 31st

Your Annuity Benefit is expressed as an accumulation account that grows each year due to contribution credits and interest credits. It is a multiemployer, individual account Defined Contribution Plan, and a Profit-Sharing account which means interest is based on the Plan’s investment earnings. Investments are Trustee-directed.

- Beginning Balance

- - Minus Payouts

- - Minus the Administration Fee

- The remaining balance is then multiplied by the Interest Rate

You shall become a Plan Participant when your employer is required to make contributions to the Annuity Fund on your behalf pursuant to a written agreement between the Union and your employer. All participants of the Carpenters Savings Plan of Philadelphia & Vicinity as of December 31, 2022, automatically became Eastern Atlantic States Carpenters Annuity Plan Participants as of January 1, 2023. You are always 100% vested in your individual account.

The Eastern Atlantic States Annuity Fund is a Profit Sharing Account, which means interest is based on the Annuity Plan's investment earnings.

Valuations

Most of the accounts are invested in stocks, bonds, real estate and other investment vehicles by professional Investment Managers selected by the Trustees with the advice of a professional Investment Advisor. These are valued once each year on December 31st (“The Valuation Date”) or more frequently, at the discretion of the Trustees.

Investment Options

The assets in your account are invested by the Trustees as described above.

Post-merger EASCAF will allow distributions for the following reasons:

- Retirement or Death

- Total & Permanent Disability

- 12 months after Separation of Service

- In-Service at Age 59 ½

- Qualified Domestic Relations Order (“QDRO”)

- Hardship Withdrawal

- Medical Expenses

- Purchase or Construction of Principal Residence

- Home improvements due to Catastrophic Life Events

- Educational Fees

- To Prevent Eviction from Principal Residence or Foreclosure of mortgage

- Funeral Expenses.