Savings Plan Overview

Active Participants

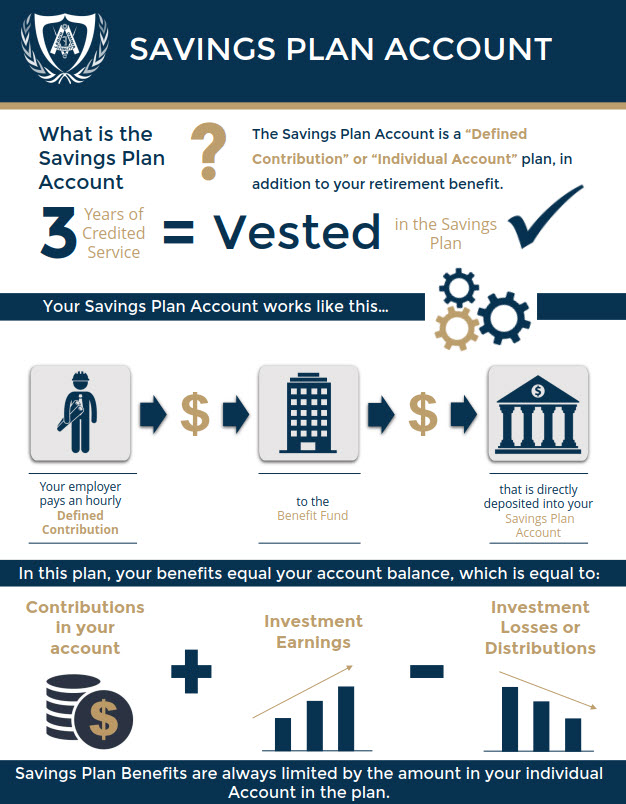

You are an "Active Participant" in the Savings Plan after you have earned at least one Credited Hour. The Savings Plan Account is designed to be an additional retirement benefit, which has no effect upon your regular pension or "Annuity Account" benefit. The basic differences between the Savings Plan Account and an "Annuity Account" under the Carpenters Pension & Annuity Plan of Philadelphia & Vicinity are as follows:

Interest is not fixed or guaranteed in the Savings Plan.

Savings Plan accounts are NOT guaranteed by the Pension Benefit Guaranty Corporation.

The Savings Plan is a "Defined Contribution" plan for legal purposes, while the "Annuity Account" is part of a "Defined Benefit" plan.

A lump sum is the only payment option for your "Basic Account" (or an inherited account from the former Local 626, 1545 or 2012 plans) under the Savings Plan.

Your spouse must be the beneficiary for 100% of your Basic Account, unless he or she waives that right.

SAVINGS PLAN RESOURCES

KEYWORDS & DEFINITIONS

Savings Plan Vesting

"Vesting" means you remain entitled to your Account in the Savings Plan, regardless of whether you continue to work in Covered Employment until retirement.

You are "vested" in your Basic Account under the plan if you:

- have earned at least three (3) Years of Vesting Service,

- were working as an Eligible Employee or in "contiguous service" with a Contributing Employer at your Normal Retirement Date,

- have an April 30, 1998 Account, or

- had earned at least two (2) Years of Vesting Service prior to December 1, 2008.

Credited Hours are used to determine your vesting status and eligibility to receive a distribution of your Savings Plan Basic Account. Credited Hours are a combination of the following items:

- Payment Hours, also called "Contribution Hours," are hours you worked for which employer contributions are paid to the Savings Fund for your work as an Eligible Employee.

- Pre-Merger Hours. Hours that were credited under the Local 600 Annuity Plan before May 1, 1998, Credited Hours under the Carpenters Pension & Annuity Plan of Philadelphia & Vicinity as of May 1, 1998, and hours that were credited to you for vesting under the Carpenters Local 626 Pension & Annuity Plan, the Millwrights and Machinery Erectors Local No. 1545 Pension Plan or the Local 2012 (Baltimore) Annuity Plan as of May 1, 2002 are treated as credited hours under the Savings Plan.

- Reciprocal Hours. You are credited with hours for which contributions are paid to the Savings Fund under the United Brotherhood of Carpenters & Joiners of America National Reciprocal Agreement for Annuity Funds or another reciprocal agreement.

- Delinquent Hours. Delinquent Hours are hours you worked for which employer contributions are due but which have not been paid to the Savings Fund for your work by the delinquent employer. Your work record card must be returned to receive credit.

- Weekly Disability or Workers' Compensation Hours. You are credited with hours during an absence for which you receive short-term weekly disability benefits from the Carpenters Health & Welfare Fund of Philadelphia & Vicinity or Workers' Compensation.

- School Hours. School hours are credited for classroom time in apprenticeship training with the Carpenters Joint Apprenticeship Committee of Philadelphia and Vicinity.

- Family or Medical Leave Hours. You are credited with hours during an absence (after August 26, 1984) for pregnancy, childbirth, adoption, child care or (after February 5, 1994) family or medical leave up to the limit allowed by federal law. You will need to notify the Fund Office at the time of your absence to keep records straight.

- Contiguous Employment. You receive hours credit for work in Contiguous Employment.

- Qualified Military Service. You receive hours credit for qualified military service based on your average hours within the 12 months before you left work for military service.

Credited hours that fall into two categories will only be counted once.

Contributions are NOT required for all Credited Hours. Contributions to your Account will only be credited for Payment Hours, Pre-Merger Hours with contributions to a prior plan, Reciprocal Hours with actual payment of contributions to the Savings Fund and, upon a timely return and employer payment of contributions, Qualified Military Service after 1994 (or, if later, the date your local joined the Savings Fund). No contributions are credited to your Account for Delinquent Hours, Weekly Disability or Workers' Compensation Hours, Contiguous Employment, Family or Medical Leave Hours or School Hours unless and until contributions actually are paid to the Savings Fund for those hours under a collective bargaining agreement.

You are an "Eligible Employee" who can participate in the Plan if you fall into one of the following categories.

- You work under a collective bargaining agreement that requires contributions to the Carpenters Pension and Annuity Fund of Philadelphia and Vicinity.

- You work for a contributing employer that has signed a Participation Agreement with the Plan for work outside a Carpenters bargaining unit. These agreements generally require contributions for a minimum of 40 hours per week. An employee who has another "Home Fund" under a reciprocal agreement CANNOT participate in the Plan.

Covered Employment is work covered by a collective bargaining agreement in carpentry or a related trade within our geographic area, or a reciprocal area that requires an employer to make contributions to the Savings Plan. Covered Employment also includes work as an employee of an employer which is required to contribute to the Plan under a participation agreement.

You may need to sign an authorization for the transfer of contributions pursuant to a reciprocal agreement.

"Contiguous Employment" is work with a Contributing Employer which immediately precedes or follows Covered Employment. There cannot be a quit, discharge or retirement in between Covered Employment and Contiguous Employment. Work with an affiliated employer of a Contributing Employer, such as a parent company, does NOT count for any purpose under the Plan. Contiguous Employment does not result in additional contributions to your Savings Plan account.

You can lose your Savings Plan Basic Account if you leave work with the employers who contribute to the Savings Fund or become "inactive" before you have vested. You will be considered an "inactive" participant if you have less than 200 Credited Hours during any Plan Year.

If you are not vested in any part of your Account under the Plan when you become an Inactive Participant, your Basic Account will be cancelled. If you return to Covered Employment before a Permanent Break (five consecutive Plan Years with less than 200 hours), your Basic Account will be restored. If you become an Inactive Participant after vesting, you will retain your Account and continue to earn investment income on your Account until it is distributed. You will not have the same retirement options as Active Participants. Your distribution options must follow the rules as outlined in the section on Termination of Employment.

If you become an Inactive Participant before you are vested in your benefit and if you remain inactive for five (5) Plan Years, your Savings Plan Basic Account balance will be permanently forfeited. If subsequently you return to work in Covered Employment, your Basic Account will start from zero and will only be credited with new contributions.

If your Basic Account is permanently forfeited, all amounts forfeited shall be used first to pay the administrative expenses of the Plan, with the excess of amounts forfeited over and above the administrative expenses allocated to Participant's Basic Accounts. Forfeited amounts shall be valued at your termination date.